Families, Trusts, & Estates

Families often own significant real estate assets, both undeveloped land and improved property. In many cases, the properties are part of a Trust or an Estate. There are frequently unanswered questions and differing opinions regarding the appropriate strategy with respect to these assets. Some common questions include:

What are the family’s goals for the asset?

What is the property’s highest and best use, and what is its potential value?

Is now an opportune time to sell, or should the asset be held for future value appreciation?

What is the best strategy to maximize the sale proceeds from the property? Is it to sell in bulk, or to subdivide and sell as smaller tracts?

Answering these and other questions requires objective counsel based on market knowledge and professional expertise. Our engagements with family clients are typically structured in two phases. The first phase generally involves a thorough analysis of the property and market in order to formulate the recommended strategy. The second phase focuses on implementation, which could entail a property disposition, negotiating a lease, or helping to structure a joint venture. For several family clients, we serve as an ongoing strategic advisor as real estate issues arise.

Recent Examples of Our Work with Family Clients

Client: Family trust

Location: LaGrange, Georgia

Two family trusts own over 1,800 acres west of downtown LaGrange. In 2016, Haddow & Company was hired to prepare an investment strategy aimed at monetizing portions of the property, while balancing a desire for quality development that will benefit the community. When our firm was retained, the city was building a road through the property. Since completing the investment strategy, Haddow & Company has been marketing selected tracts for sale and serving as an ongoing advisor to the trusts. Significant progress has been made, as a Publix-anchored shopping center recently opened and a national apartment developer has broken ground on 320 units.

Client: Family

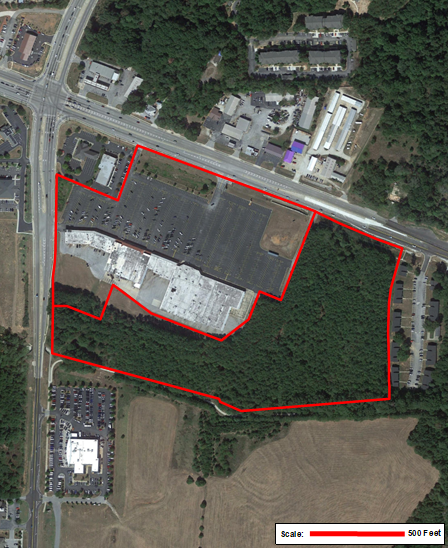

Location: Covington, Georgia

In September 2020, our firm was hired by a family to conduct a highest and best use analysis of a 147,000-square-foot shopping center and 19 acres of adjacent, undeveloped land in Covington, Georgia. At that time, the shopping center was only 33% leased. While the small shop space was performing fine, the bulk of the vacancy stemmed from Walmart relocating in 2005. Our study provided the following key conclusions and recommendations:

Covington needed additional multifamily housing, and the undeveloped land was ideal for an apartment community. This would create a horizontal mixed-use development in concert with the shopping center, and the owner could then reinvest a portion of the land sales proceeds into upgrading the common areas and façade of the shopping center.

The local retail market was healthy and there was nothing fundamentally wrong with the shopping center. However, most big-box tenants chose to concentrate stores in nearby Conyers, so ownership needed to take a different approach to leasing the vacant Walmart box by subdividing the space for multiple tenants.

Following the completion of the highest and best use analysis, the owner retained our firm to market the 19 acres of land to apartment developers and to serve as an ongoing adviser in repositioning the vacant Walmart space. Three years later, a new apartment community has recently opened, the newly refreshed shopping center is 97% leased, and the annual rental revenue has nearly tripled.